Canadians Turn to Friends and Siblings for Home Buying

Over 60% of Canadians consider shared mortgages with friends or siblings to tackle high house prices. As house prices continue to climb, making homeownership increasingly unattainable for many, Canadians are exploring alternative financing options.

A new survey by Compare the Market Australia indicates a significant shift towards collaborative home buying among Canadians, with a majority expressing willingness to partner with friends and siblings to enter the housing market.

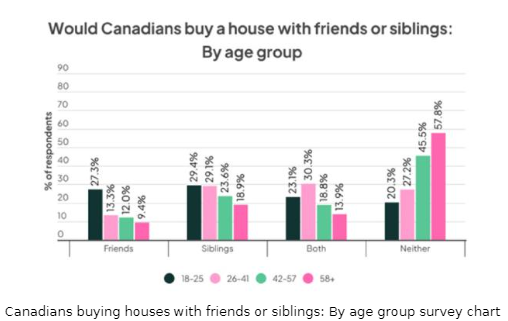

The survey shows that over 60 percent of Canadians are open to purchasing a home with a friend, sibling, or both, with specific figures showing 25 percent would buy with siblings, 14 percent with friends, and 22 percent with both.

This trend places Canadians ahead of their American and Australian counterparts in terms of willingness to share a mortgage; 55.2 percent in the US and 56.4 percent in Australia.

Younger Canadians, particularly those aged 18 to 25, are more likely to consider buying with friends or family, with nearly 80 percent of respondents in this age group open to such arrangements.

Previous home buying trends highlight that 42.5 percent of participants have purchased homes with a romantic partner, while nearly a third have never bought a home before. Another 21 percent have bought independently.

Despite the growing interest in joint home purchases, concerns remain.

The top concerns among potential buyers include the fear of risking the relationship (55.2 percent), differing opinions on suitable properties (47.1 percent), financial irresponsibility of the potential co-buyer (14.2 percent), lack of trust (11.9 percent), and insufficient familiarity with the co-buyer (8.2 percent).

Stephen Zeller, general manager of Money at Compare the Market, highlights the importance of understanding the legal implications of joint home ownership.

He advises that non-spousal co-buyers need to clearly define ownership percentages and responsibilities before proceeding.

Zeller notes that some lenders may require each party to own at least a 25 percent share of the home, and it is possible to establish a legal agreement specifying each party's share to prevent future disputes.

Article courtesy of Freschia Gonzales

Image by Holiak on Freepik